Life Insurance in and around Austin

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

One of the greatest ways you can protect your loved ones is by taking the steps to be prepared. As pained as pondering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Love Well With Life Insurance

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less overwhelming. Life insurance provides financial support when it’s needed most. Coverage from State Farm allows time to grieve without worrying about expenses like utility bills, college tuition or childcare costs. You can work with State Farm Agent Ted Heaton III to express love for your family with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

When you and your family are protected by State Farm, you might not have to worry because even if something bad does happen, your loved ones may be covered. Call or go online now and discover how State Farm agent Ted Heaton III can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Ted at (512) 343-8774 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

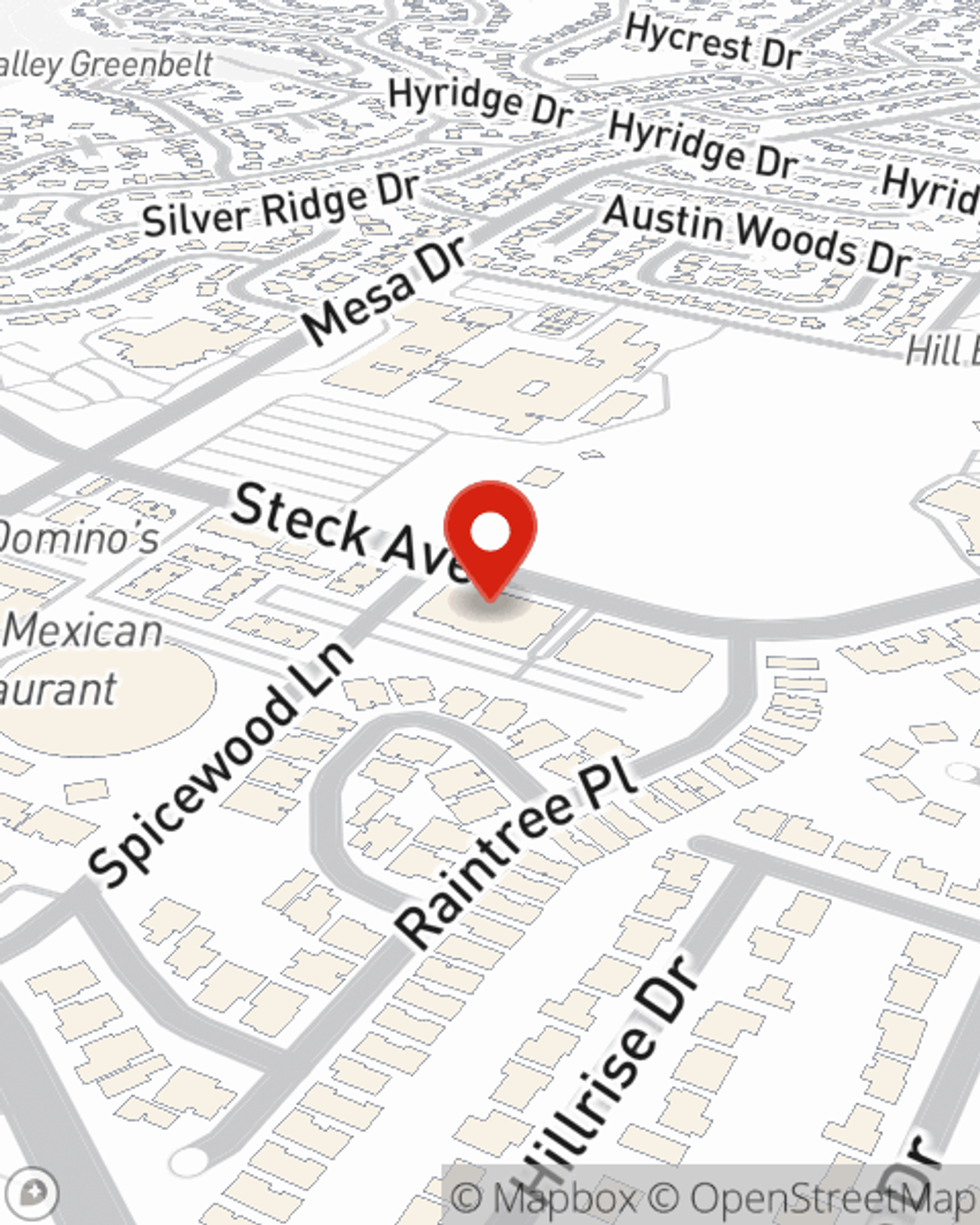

Ted Heaton III

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.